Citigroup (C) reported earnings this morning, with both EPS and revenues coming in light of expectations. Maybe. The consensus EPS estimate was $1.02; the bank reported $0.95.

Much of the miss was due to a $1.3 billion accounting loss due to a credit value adjustment (CVA). CVA is an accounting rule mandating firms write up or down the value of their own debt. Removing this line item would add $0.16 a share to Citi's earnings, resulting in $1.11 EPS for the quarter, according to Bloomberg.

To figure out whether or not your personal "go to" analyst had this CVA in his model, dig through their latest report. As was the case last week with JP Morgan (JPM) and Wells Fargo (WFC), the number itself is less important than the reaction of the stock market.

Citi is to accounting "noise" what Goldman Sachs (GS) is to public loathing: the preeminent name in the class. Citi was bailed out, realigned and shuffled in a thousand different ways. CEO Vikram Pandit has done yeoman's labor getting the once proud institution moving again, but he has a long way to go before the company regains its former glory.

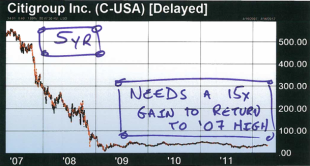

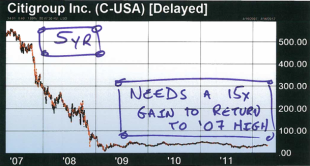

How long is the road for Pandit?

Citi would need a 15.1 fold gain to get to $550, where it traded in 2007. Citi's 93% drop in the last five years compares to 11% and 5% for JPM and WFC.

The point isn't to mock Citi but to point out that the company isn't as relevant as once it was, even with a near $100b market cap. In the attached clip, Nesto notes that over 60% of analysts surveyed by FactSet have the company rated buy or higher with 23% at hold. On Wall Street that amounts to a shrug.

If you're inclined to claim Citigroup beat expectations, the CVA supplies you with ample evidence. If you wish to say they missed, simply point to the reported bottom line. Should you wish to talk about what "matters" regarding Citigroup, watch the market's reaction to the abstract news.

In the early going, Citi is moving higher and taking the Financial stocks (XLF) as a whole with it. Goldman Sachs reports earnings tomorrow morning followed by Morgan Stanley (MS) and Bank of America (BAC) on Thursday.

Those are better "tells" for the financial sector as a whole.

europe europe LOL

Rr

Much of the miss was due to a $1.3 billion accounting loss due to a credit value adjustment (CVA). CVA is an accounting rule mandating firms write up or down the value of their own debt. Removing this line item would add $0.16 a share to Citi's earnings, resulting in $1.11 EPS for the quarter, according to Bloomberg.

To figure out whether or not your personal "go to" analyst had this CVA in his model, dig through their latest report. As was the case last week with JP Morgan (JPM) and Wells Fargo (WFC), the number itself is less important than the reaction of the stock market.

Citi is to accounting "noise" what Goldman Sachs (GS) is to public loathing: the preeminent name in the class. Citi was bailed out, realigned and shuffled in a thousand different ways. CEO Vikram Pandit has done yeoman's labor getting the once proud institution moving again, but he has a long way to go before the company regains its former glory.

How long is the road for Pandit?

Citi would need a 15.1 fold gain to get to $550, where it traded in 2007. Citi's 93% drop in the last five years compares to 11% and 5% for JPM and WFC.

The point isn't to mock Citi but to point out that the company isn't as relevant as once it was, even with a near $100b market cap. In the attached clip, Nesto notes that over 60% of analysts surveyed by FactSet have the company rated buy or higher with 23% at hold. On Wall Street that amounts to a shrug.

If you're inclined to claim Citigroup beat expectations, the CVA supplies you with ample evidence. If you wish to say they missed, simply point to the reported bottom line. Should you wish to talk about what "matters" regarding Citigroup, watch the market's reaction to the abstract news.

In the early going, Citi is moving higher and taking the Financial stocks (XLF) as a whole with it. Goldman Sachs reports earnings tomorrow morning followed by Morgan Stanley (MS) and Bank of America (BAC) on Thursday.

Those are better "tells" for the financial sector as a whole.

europe europe LOL

Rr

הודעות חשובות

הודעות חשובות

למרות הכניסה המרשימה של פועלים אקוויטי לפי שווי...

למרות הכניסה המרשימה של פועלים אקוויטי לפי שווי של מיליארד שקל והגב של JTLV, הסקפטיות שלך מובנת

adamt היום, 15:06לגייס 180 מיליון שקל בריבית של 6.25% זה מהלך שמחייב ביצועים מושלמים בשטח ובתחום ההתחדשות העירונית תמיד...