The stock rout shows no signs of abating. The MSCI All Country World Index is falling for the 10th day in 13, bringing its decline for the year to 10 percent. The big concerns:China's deteriorating economy and the sliding price of oil. Asian stocks sank to the lowest level since September 2012. China shares listed in Hong Kong - otherwise known as H-shares - dropped to a level not seen since the depths of the global financial crisis in March 2009. The city's dollar dropped to the weakest since 2007.

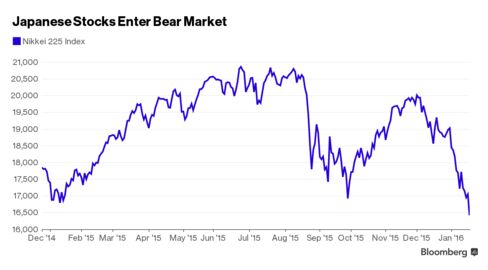

Japan's Nikkei 225 Index and Topix Index sank into bear markets, both falling more than 20 percent from their 2015 highs, as investors question the strength of the global economy. Both indexes are oversold, according to technical indicators. The Japanese yen remains the world's haven of choice. It rose to the highest against the U.S. dollar in a year and has gained against all 31 of its major peers in 2016.

A Bloomberg gauge tracking the world's biggest oil and gas companies slumped to its lowest since early 2004 as crude continues its downward spiral. West Texas Intermediate sank another 3.6 percent today, dropping to a September 2003 low of $27.42 as investors await the latest U.S. inventory data. Stockpiles probably increased by 2.75 million barrels last week, according to a Bloomberg survey. Yesterday the International Energy Agency said global oil markets could "drown in oversupply," sending prices even lower as demand growth slows and Iran boosts exports with the end of sanctions. Crude has plunged 26 percent in 2016. The Bloomberg World Oil & Gas Index is down 12 percent.

U.K. gilts rose as European equities dropped, sending the yield on the 10-year bond to the lowest since April. It's been a world-beating year for U.K. government bonds, with the asset class posting returns of 2.2 percent, the best among developed-market sovereign bonds, according to Bloomberg World Bond Indexes. They are deemed a haven as turbulence rages across global financial markets. Gilts have also benefited from a repricing of interest rate expectations as the domestic economy slows and inflation expectations drop. Bank of England Governor Mark Carney captured the mood yesterday: "Now is not yet the time to raise interest rates," he said. Traders aren't fully pricing in a quarter-point increase to the U.K.'s 0.5 percent benchmark rate until after March 2017.Mark Barton is a presenter on Bloomberg TV. Follow him on Twitter @markbartontv

הודעות חשובות

הודעות חשובות

מדד ה-VIX שער: 20.78 נק' הגרף נמצא...

מדד ה-VIX

חיפושית כחולה אתמול, 23:30שער: 20.78 נק'

הגרף נמצא בתנודתיות ויש סיכוי שיעבור ברמת ה-23 נק'. לגרף יש רמת התנגדות משמעית ברמה של 50 נק'.

https://www.s-maof.com/Forum/attachment.php?attachmentid=12347&stc=1...