European equities fell with stocks in Asia, where Chinese shares tumbled back into a bear market. Oil fell back below $31 a barrel, while the yen and gold gained as investors sought havens from the selloff.The Stoxx Europe 600 Index lost 0.5 percent as of 8:17 a.m. in London.

Asian equities sank toward a three-year low as the Shanghai Composite Index’s drop wiped out gains from an unprecedented state rescue campaign. West Texas Intermediate fell 2.8 percent, Standard & Poor’s 500 Index futures slipped 0.7 percent and copper snapped a two-day gain. The yen strengthened against all 16 major peers tracked by Bloomberg and gold rose 0.6 percent.

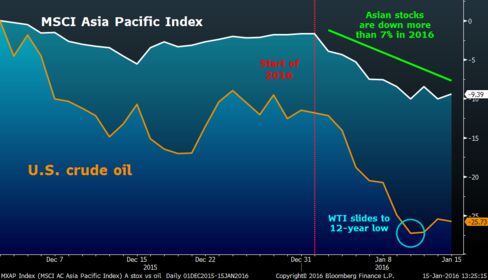

Moves in oil and China have dominated global trading in 2016.

With crude dropping below $30 a barrel this week, Norway sees a crisis in its industry, while signs that Iran is moving closer to boosting exports may exacerbate a supply glut. Concern about the rout in oil and the state of China’s economy is dominating global markets in 2016, helping spur a $5.6 trillion equity selloff and weighing on currencies in commodity-producing nations from Australia to Canada.

“A rebound in equities isn’t going to be sustainable until volatility comes down and until we get a sense that the Chinese economy is doing better or at least is moving in the right direction,” Herald van der Linde, Hong Kong-based head of equity strategy for the Asia Pacific at HSBC Holdings Plc, said in an interview from Singapore. “China’s economy is struggling to turn around."Stocks

Templeton's Arnold: Tremendous Opportunities in Europe

The Shanghai Composite Index sank 3.5 percent at the close, falling more than 20 percent from its December high and dropping below its low during the depths of a $5 trillion rout in August. Friday’s decline was attributed to persistent investor concerns over volatility in the yuan and a report that some banks in Shanghai have halted accepting shares of smaller listed companies as collateral for loans.A gauge of Chinese stocks in Hong Kong slumped 2.6 percent. New yuan loans trailed forecasts in December even as the broadest measure of new credit surged the most since June, data showed Friday. Hong Kong’s Hang Seng Index lost 1.5 percent, while a gauge of emerging-market equities sank 0.7 percent.

“The week has certainly been unpredictable and very volatile,” said Geoffrey Ng, a Kuala Lumpur-based director at Fortress Capital Asset Management Sdn., which oversees $238 million. “A lot of the Asian markets have derated and we’re seeing opportunities emerge,” although it’s hard to gauge what the trend will be in the next few weeks, he said.The S&P 500 swung back to gains on Thursday, rallying 1.7 percent as the Dow Jones Industrial Average reclaimed more than 200 points. U.S. stocks got a boost after Fed Bank of St. Louis chief James Bullard said the rout in energy prices may dent inflation expectations.CurrenciesAustralia’s dollar slipped 0.8 percent to 69.27 U.S. cents. New Zealand’s dollar, the worst-performing major currency against the greenback in 2016 after South Africa’s rand, weakened 0.6 percent. The yen gained 0.3 percent to 117.73 per dollar.Hong Kong’s dollar fell 0.1 percent after weakening 0.3 percent on Thursday, the most since 2003, amid speculation the city’s 32-year-old currency peg will end as investors lose confidence in Chinese assets. Authorities will closely monitor the currency’s movement, Financial Secretary John Tsang said to reporters on Friday.The offshore yuan headed for a 1 percent weekly gain. China’s central bank intervened to support the exchange rate in Hong Kong after a slide in the first trading week of 2016 roiled global financial markets. Policy makers set the onshore currency’s fix little changed for a sixth day on Friday.CommoditiesWTI futures lost as much as 3.3 percent to $30.17 a barrel and are down 8.4 percent for the week. International sanctions on Iran may be lifted Monday, allowing for a boost in oil shipments from the fifth-biggest member of the Organization of Petroleum Exporting Countries. The European benchmark’s discount to WTI widened to the biggest intraday gap since July 2010.“Lower oil prices have been a sentiment leader for the recent market selloff and will again be in focus with Iranian sanctions expected to be lifted next week,” Ric Spooner, chief analyst at CMC Markets in Sydney, wrote in a note Friday. “How fast Iran can put oil back on the market will now be a key issue for oil markets, with many skeptical that it will be able to do this nearly as fast as it has forecast.”Base metals retreated, with copper falling 1 percent on the London Metal Exchange and zinc dropping 2 percent.Bullion for immediate delivery rose 0.6 percent to $1,084.59 an ounce, paring its weekly drop.

With crude dropping below $30 a barrel this week, Norway sees a crisis in its industry, while signs that Iran is moving closer to boosting exports may exacerbate a supply glut. Concern about the rout in oil and the state of China’s economy is dominating global markets in 2016, helping spur a $5.6 trillion equity selloff and weighing on currencies in commodity-producing nations from Australia to Canada.

“A rebound in equities isn’t going to be sustainable until volatility comes down and until we get a sense that the Chinese economy is doing better or at least is moving in the right direction,” Herald van der Linde, Hong Kong-based head of equity strategy for the Asia Pacific at HSBC Holdings Plc, said in an interview from Singapore. “China’s economy is struggling to turn around."Stocks

Templeton's Arnold: Tremendous Opportunities in Europe

The Shanghai Composite Index sank 3.5 percent at the close, falling more than 20 percent from its December high and dropping below its low during the depths of a $5 trillion rout in August. Friday’s decline was attributed to persistent investor concerns over volatility in the yuan and a report that some banks in Shanghai have halted accepting shares of smaller listed companies as collateral for loans.A gauge of Chinese stocks in Hong Kong slumped 2.6 percent. New yuan loans trailed forecasts in December even as the broadest measure of new credit surged the most since June, data showed Friday. Hong Kong’s Hang Seng Index lost 1.5 percent, while a gauge of emerging-market equities sank 0.7 percent.

“The week has certainly been unpredictable and very volatile,” said Geoffrey Ng, a Kuala Lumpur-based director at Fortress Capital Asset Management Sdn., which oversees $238 million. “A lot of the Asian markets have derated and we’re seeing opportunities emerge,” although it’s hard to gauge what the trend will be in the next few weeks, he said.The S&P 500 swung back to gains on Thursday, rallying 1.7 percent as the Dow Jones Industrial Average reclaimed more than 200 points. U.S. stocks got a boost after Fed Bank of St. Louis chief James Bullard said the rout in energy prices may dent inflation expectations.CurrenciesAustralia’s dollar slipped 0.8 percent to 69.27 U.S. cents. New Zealand’s dollar, the worst-performing major currency against the greenback in 2016 after South Africa’s rand, weakened 0.6 percent. The yen gained 0.3 percent to 117.73 per dollar.Hong Kong’s dollar fell 0.1 percent after weakening 0.3 percent on Thursday, the most since 2003, amid speculation the city’s 32-year-old currency peg will end as investors lose confidence in Chinese assets. Authorities will closely monitor the currency’s movement, Financial Secretary John Tsang said to reporters on Friday.The offshore yuan headed for a 1 percent weekly gain. China’s central bank intervened to support the exchange rate in Hong Kong after a slide in the first trading week of 2016 roiled global financial markets. Policy makers set the onshore currency’s fix little changed for a sixth day on Friday.CommoditiesWTI futures lost as much as 3.3 percent to $30.17 a barrel and are down 8.4 percent for the week. International sanctions on Iran may be lifted Monday, allowing for a boost in oil shipments from the fifth-biggest member of the Organization of Petroleum Exporting Countries. The European benchmark’s discount to WTI widened to the biggest intraday gap since July 2010.“Lower oil prices have been a sentiment leader for the recent market selloff and will again be in focus with Iranian sanctions expected to be lifted next week,” Ric Spooner, chief analyst at CMC Markets in Sydney, wrote in a note Friday. “How fast Iran can put oil back on the market will now be a key issue for oil markets, with many skeptical that it will be able to do this nearly as fast as it has forecast.”Base metals retreated, with copper falling 1 percent on the London Metal Exchange and zinc dropping 2 percent.Bullion for immediate delivery rose 0.6 percent to $1,084.59 an ounce, paring its weekly drop.

הודעות חשובות

הודעות חשובות

מה הקפיץ את מניית משק אנרגיה לצמרת התשואות של הבורסה?

מניית חברת האנרגיה ניתרה מתחילת השנה ב־156% - התשואה הרביעית בגובהה במדד ת"א־125. מאחורי הזינוק הנחשולי עומד הצפי לעלייה בביקוש לחשמל וסיבוב פרסה ברגולציה. עם זאת, בשוק יש מי שחושש מהלוואת הענק שנטלה...

גרוס היום, 10:31